nanny tax calculator canada

Calculation of net and gross pay taxes CPP and EI amounts. Establish regular working hours for example 9 am.

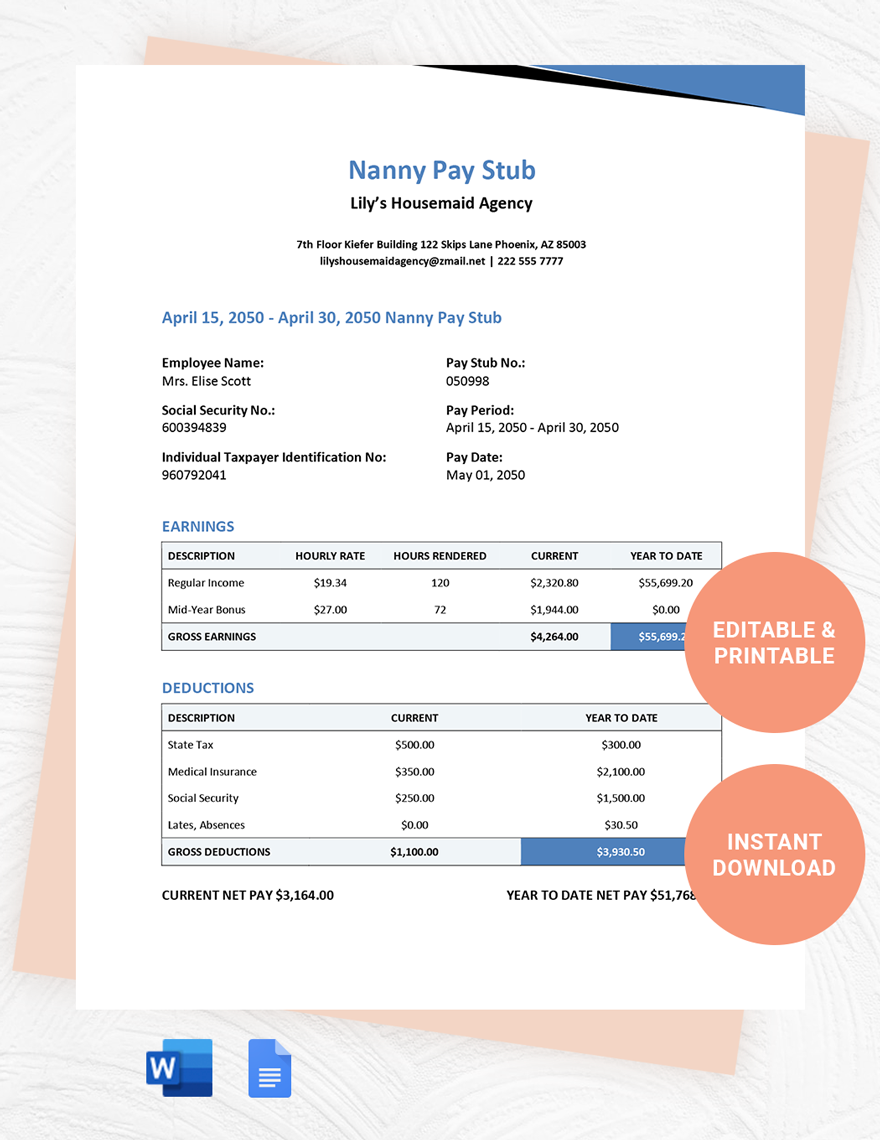

Pay Stub Sheets Templates Google Docs Format Free Download Template Net

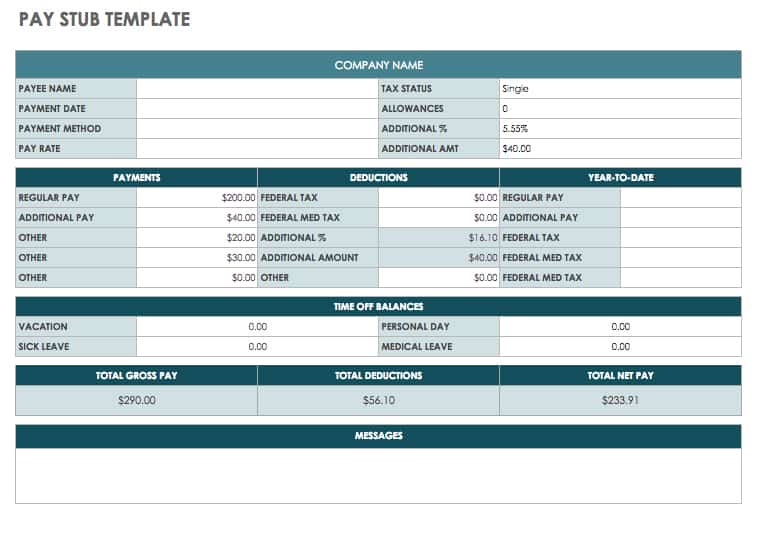

It will confirm the deductions you include on your.

. The Nanny Tax Calculator. You can also print a pay stub once the pay has been. Fill in the salary.

Net Pay of 500week. You can claim up to 8000 for each. Maths for Mums and Dads guides you through the basics of.

This calculator provides calculations based on the information you provide. Line 21400 Child care expenses. You are considered to be an employer when all the following apply to you.

Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it. This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. Calculating nanny taxes.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. To 5 pm assign and supervise the tasks. Nanny Wage 40 hrs week.

As mentioned nanny taxes fall into two main buckets for employers. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. Canada Revenue Agency CRA registration.

Nanny Take Home Pay. Working parents need an experienced nannyhouse manager in Darien CT. Were here to help.

Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. Paying your nanny via direct deposit. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator.

Nanny Tax Hourly Calculator. Nanny Tax Calculator Canada. Our new address is 110R South.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. Report IV1 was then published in August 2010 and provided the first draft text of a proposed Convention and Recommendation.

The Nanny Tax Company has moved. Nanny Take Home Pay. Call 800 0000 1952.

A household employer is responsible to remit 765 of their workers. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. How often is it paid.

Nanny tax calculator canada Wednesday September 14 2022 Edit. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Heartpayroll is canadas most used household payroll tax.

Our payroll services will take care of. Were here to help. Lines 21999 and 22000 Support payments.

A household employer is responsible to remit. Employer Out of Pocket Expense. As you may know you can deduct child care expenses including a nanny against your eligible employment or self-employment income.

Nannytax Payroll Services for UK Employers - Nannytax.

![]()

Income Tax Calculator 2022 Canada Salary After Tax

Nannytax Nannytaxcanada Twitter

Free Pay Stub Templates Smartsheet

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Nanny Tax Payroll Calculator Gtm Payroll Services

7 Best Small Business Payroll Programs In Canada Business Org

Nanny Tax Payroll Calculator Gtm Payroll Services

Babysitting Taxes Usa What You Need To Know

Payroll Calculator Canada Google Play म एपहर

Tax Definitions Tax Glossary I Tax Defense Network

Nanny Tax Calculator Gtm Payroll Services Inc

Nannypay 1 Diy Payroll Software How To Pay The Nanny Tax

2022 Income Tax Calculator Canada

Tax Filing Tips For Hair Salons Barbers And Hairdressers Turbotax Tax Tips Videos

Doing The Right Thing By Paying The Nanny Tax The New York Times